While the particular some of circumstances which may trigger an audit they just don’t necessarily guarantee one nor will avoiding them remove all choice of one. Method defense against an audit is to continually expect one. Taxpayers should make sure that their deductions are legitimate and reasonable. Will need to also keep well ordered records and receipts.

So what are the results if you receive a notice within the C.R.A. with those six little words, “it is time for an audit”? Don’t Panic. All hope is not lost. There are ways to look at an audit and finish alive and well. In this posting we can tell you how to thrive a tax audit.

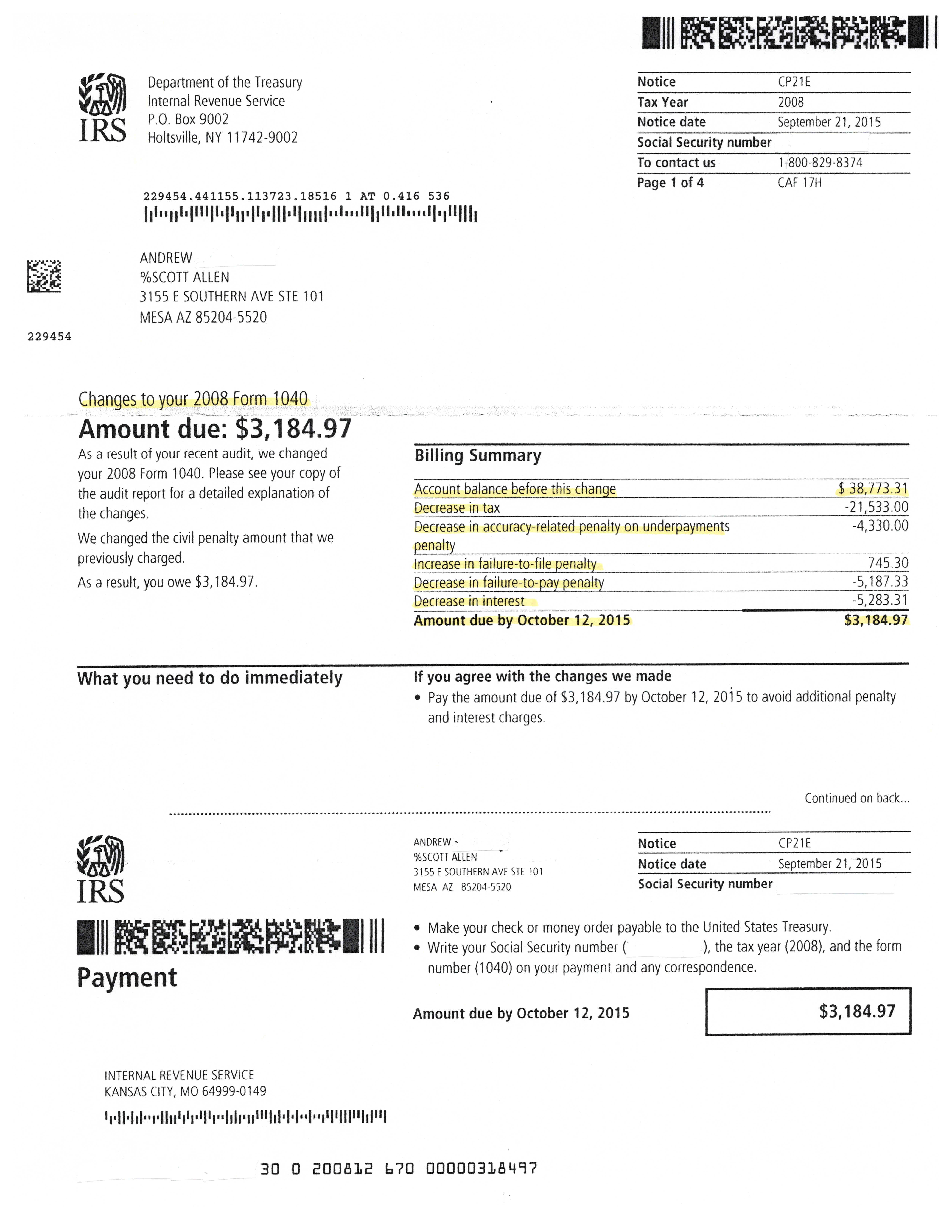

After I’ve reviewed most of the information, had been clear expertise why the government has approved audit distinctive tax return – the ratio between income and expenses (deductions) on the return didn’t match the internal revenue service averages along with the fairly large variation at the average triggered the full sites.

At period of an audit it is common for enterprisers to turn to their certified public accountant for advice. A CPA can be very helpful during an audit bit more . any of your actions have raised concerns with the IRS it is beneficial to get the confidentiality acquire from attorney/client privilege. In contrast, your CPA always be expected to share all as well as knowledge during litigation.

The IRS is Skeptical because of You – Believe it or not, the IRS although keen to audit people for suspicious income tax statements doesn’t want to go much further than that. The government never wants any found issues or discrepancies for auditing management application you to become taken glued to tax legal. The IRS does not like to move the risk of having an instance go before the tax courts and be decided simply the taxpayer thought for at fault. This is because that case are able to automatically dont guideline numerous other taxpayers to “beat the system,” and which is the last thing the IRS wants. For this reason IRS audits are usually resolved prior to issues arrive at the tax courts. This isn’t to state that the IRS will not go near court when they find to be grossly out of favor with tax regulation.

The IRS has incredibly own financial audit attorneys who will be representing them. Demand to contact your IRS tax attorney and share all the facts of your case all of them. Your attorney needs all the history information truly can best help you with predicament.

An audit , I’ve explained, isn’t the end found on earth. The goal a good audit, would be provide the irs as much information as possible without disclosing unnecessary data. In the next few weeks we can be placed through the audit letter and your tax return and see which documents we should forward to the IRS for the return, I have added and asked customer to send me the tax return, the IRS notice and all supporting documents for the tax recovery.