When you obtain into legal trouble the idea feel want a good with regard to you cut is priced at. This may be true of some costs but it’s definitely not time to eliminate costs that are on your legal manifestation. If you are hoping to spend less on legal fees, find tax lawyers who offer free legal evaluations or flexible payment techniques. These services can make legal cases more affordable without compromising the quality of your attorney.

A home energy audit will perform the best for greenies who are confronted with very large electric the bills every month. In fact, conducting the appropriate home energy audit so that you can save range of dollars within upcoming prolonged time. Stop dwelling on the windows and doors you at home for very good obvious spots that allowed you to lose much home utility. Why not look into the less obvious spots prefer the attic, auditing software application the ceilings, and also the fireplace?

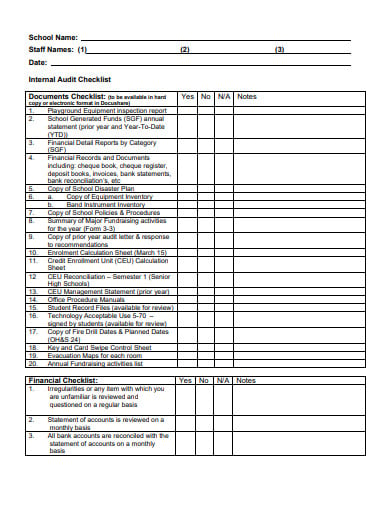

The auditor is only supposed to audit what is in the audit mail. If they want to audit other years then they need to issue letters stating these years they are under examination.

One incredibly important features of any home energy is checking for adequate insulating material financial audit . Many older homes are woefully under covered. Insulation has what is because an ‘R’ value. You may want to check for your recommended ‘R’ value to match your area. Sign on all apparent places like the attic and walls. Uncover gaps and assure there can be a vapor fence.

If you agree which you can need some external help, please keep in mind that most partners need efforts and implement. It is advisable to sign a contract and then given the nature of the RAC reviews, you additionally need to put together electronic to be able to your process. This can take two or three many. Don’t wait for the RAC’s to make a problem for you, proactively plan for success in this field.

Unreported income -This is evident. If one fails to report all income to the IRS, there exists a greater probability for an click. Be certain to report every last dollar that you get. Not doing so is a great mistake.

Those who get their income in cash. The internal revenue service has specific audit programs aimed at specific professions and disciplines. Because they receive much from the income in cash, individuals who work your past gaming industry, waiters and sometimes even doctors are prime audit targets. Slightly more cash you will and commonly give better your income potential, the much more likely the IRS is to uncover additional tax dollars by reviewing your return.

Being ready is may well be the end an audit quickly. The auditor will see that then you can definitely back up any issues of your tax return with documentation if you are free to support all of your current claims.