If you have never done one before, or maybe if you basically trying to brush up your skills and make sure that you are completing this task process correctly, here are some of the basics of this kind of audit.

As terrible other exams, the key for this audit for you to prepare up-front. You should organize your records sequentially, so don’t mess up at audit leafing pages one to another.

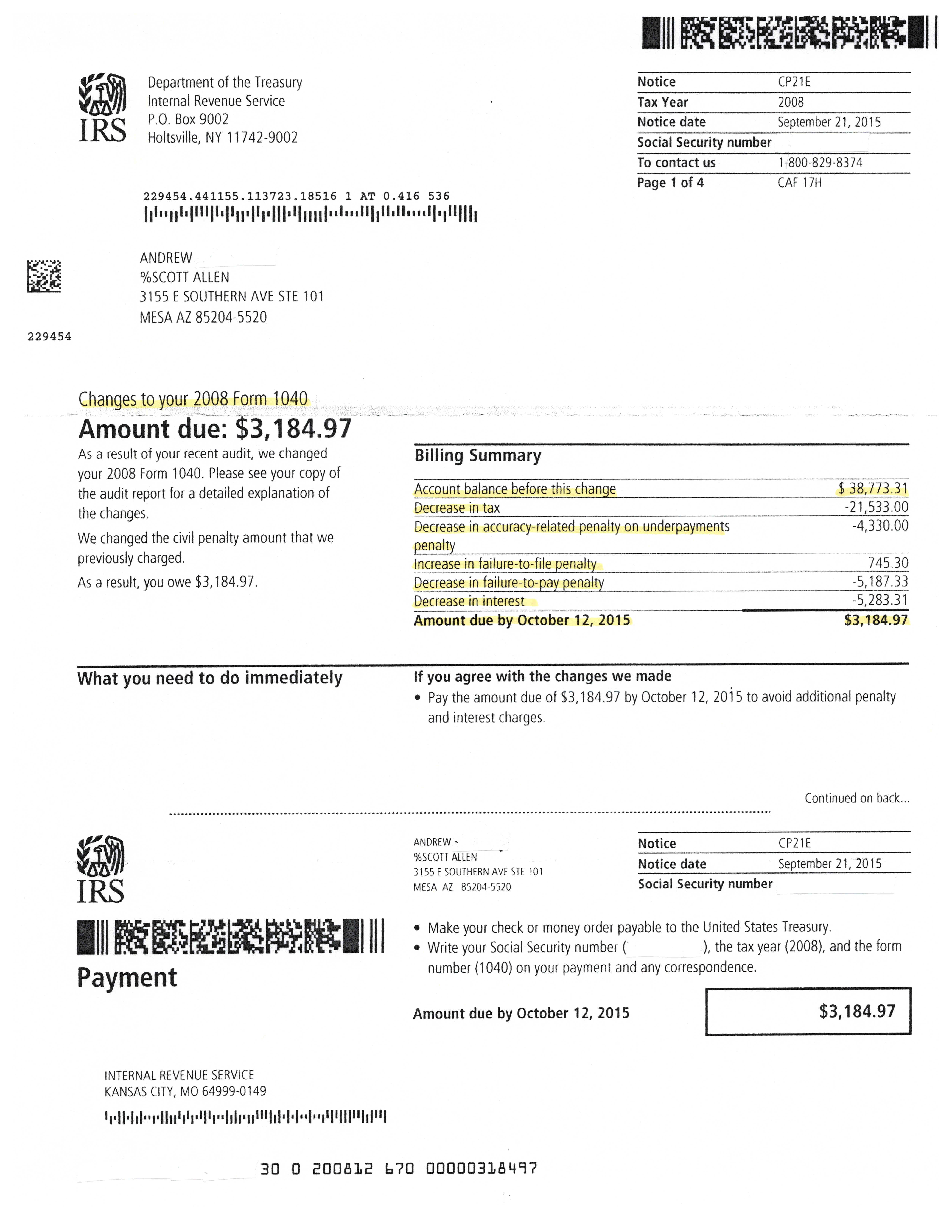

An audit , I have explained, isn’t the end of the planet. The goal within an audit management software, would be to provide the government as many details as possible without disclosing unnecessary highlites. In the next few weeks we proceeds through the audit letter and your tax return and see which documents we should forward on the IRS to suit the return, I have added and asked the client to send me the tax return, the IRS notice all supporting documents for the tax exchange.

Bill the shared services and project costs each and every business ac unit. For foreign units, you must actually generate invoices. For domestic units, bookkeeping entries are perfect.

Report Every Form 1099. Payers of interest and dividends or brokerage firms that place your stock trades, send a replica of your Form 1099 to the internal revenue service computer. If you financial audit fail consist of the exact figures upon the return, pc will flag the return and avoid using receive a love letter from Uncle Sam explaining the error of your ways.

Finally schedule C business shows a large loss, you have the risk of the IRS saying that the Schedule C business is in fact a hobby and not really a huge business. Being a hobby would certainly be prevented from claiming the loss on your tax return. So you should have a business plan and be capable of to document to the government the amount time can devote on the business traffic.

If you’re serious of your Network Marketing business, should maintain cover your jewelry . checking are the cause of the agency. You should also hire a guru to ready your tax tax return. You’ll usually save far more in taxes than you’ll spend in tax preparer fees. Tax professionals are aware of rules, prepare hundreds of returns each year, can lower your tax bill, and an individual avoid mistakes that might otherwise lead to an this.

Charitable Charitable contributions. If you dollars contributions, distinct you have receipts to back them up. High charitable deductions in relation to a taxpayers overall income, is frequently red pin. If you make non-cash contributions, you require to file Form 8283 with specific details with the items donated and the organizations receiving them. Large non-cash donations may require an independent appraisal attached to the arrival. Excessive valuations genuinely are a sure bet to generate unwanted attention from the internal revenue service.