A couple weeks in the past, we revealed which we done fundraising for fund 1 of Hustle Fund. Hustle Fund is my new enterprise budget firm, and our fund 1 is definitely an $11.5M fund focused on investing in pre-seed software startups. Eric, Shiyan, and i also could stop far more thankful to your buyers with regard to their help and support as well as lots of our loved ones who really helped us on this approach!

Knowing These Four Secrets Will Make Your Startup Venture Capital Look Amazing

I’ve authored right before as to what it’s prefer to set up a new opportunity investment capital account. But, plenty of people have asked me regarding how we in fact brought up it. Surprise amaze – we happened to run our fundraiser course of action employing the many fundraising hints I give out on this particular website!

I’ve authored right before as to what it’s prefer to set up a new opportunity investment capital account. But, plenty of people have asked me regarding how we in fact brought up it. Surprise amaze – we happened to run our fundraiser course of action employing the many fundraising hints I give out on this particular website!

First some situation

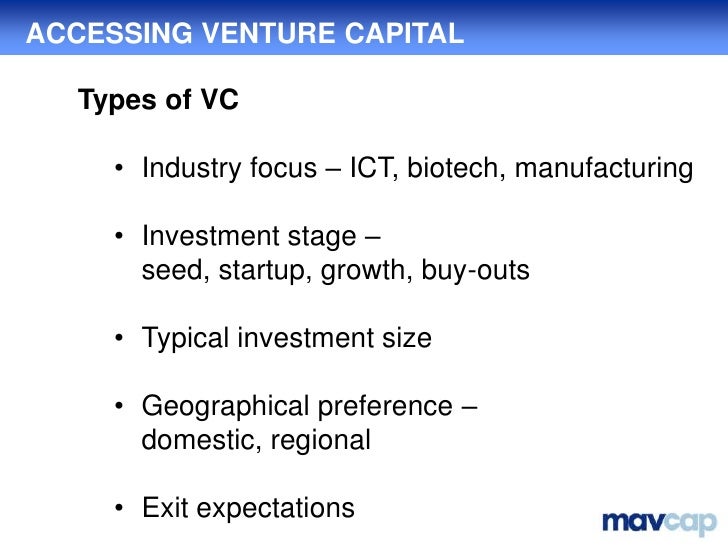

I need to expend one minute explaining slightly about endeavor cash (VC) systems. VCs boost money from other investors called very little associates (LPs). These shareholders might be persons / spouse and children offices / companies / institutional funds that put money into VC resources.

Here’s how we lifted our fund (plus some learnings):

1) We talked with a dozen account leaders before you start

I might recommend talking to a lot of new fund administrators just before moving in a) be sure this is what for you to do and b) get tips,

If you are contemplating elevating a VC funding Malaysia (spandan.nmims.edu) account. The one-most important word of advice i always read again and again from my peers was they will noticed that they had devoted considerable time courting huge institutional account purchasers once they really should have spent much more time looking to find friends and family people and workplacespersons and corporates to pitch. Once or twice to make relationships together – most likely for down the road.

If you are contemplating elevating a VC funding Malaysia (spandan.nmims.edu) account. The one-most important word of advice i always read again and again from my peers was they will noticed that they had devoted considerable time courting huge institutional account purchasers once they really should have spent much more time looking to find friends and family people and workplacespersons and corporates to pitch. Once or twice to make relationships together – most likely for down the road.

Inside the startup-fundraise planet, that is analogous to rearing from angels as opposed to. VCs. Conference with angels is likely going to be the more productive fundraiser path if you’re super early. You wish to ensure that you usually are not paying a lot of time with others who is likely to stop being committing at this time, though vCs can take group meetings along. With that being said, it is usually very good to make partnerships for down the line. This is the time tradeoff that all creator — the two item creators and new account staff — have to make.

2) We size up motives

This brings me to my subsequent issue. It’s crucial to dimensions up an investor’s motives – this also pertains when fundraising for the solution start up as well. When you’re achieving having an buyer, aim to realise why he/she is committing — just on the whole.

There are plenty of many reasons why a person desires to shell out money in businesses:

– To earn money

– To not lose money

– To adopt huge danger but essentially very high come back

– To have advertised / progress up the expert ladder by designing a good investment

– For fame and glory and bragging liberties

– To discover an organization or industry

– To group with other investors or perhaps the founding team

– and so on..

How To Lose Money With Startup Venture Capital

Points #1-4 sound identical but are basically really different. Many people are motivated by looking into making funds. Other people are determined by money preservation (not to lose cash). Many big institutional account-of-money cope with retirement options. That is certainly an illustration of this this. Their purpose is always to maintain the wealth of the day-to-day diligent individuals that entrusted their price savings in them. In case you are employed by SF MUNI and put your challenging preserved earnings from a wage to your company’s pension system, the final thing you wish to discover is that your retirement system shed all your hard earned cash by investing in some dumbass new account supervisor who invested in dogsh*t startups, consider it -! Most retirement programs is definitely not purchasing unproven very first time account supervisors.

If there’s the possible to produce further than and above a lot of hard earned cash,

Many others never imagination dropping hard earned cash. E.g. you spend $10k and contains a 95Percent chance of staying completely missing but there’s a 5Percent prospect that it could make $1m.

Then, there are plenty of no-ROI reasons why you should commit. To learn about a business or a new engineering. To boast to pals. To network system along with other purchasers or perhaps the creators. Etc. These are definitely all similarly good good reasons to spend.

Almost everyone has a combination of reasons, but it’s crucial to figure out what that combination is.

In our first gatherings because of the purchasers we satisfied with, we made an effort to assess what inspired everyone we spoke with to obtain a feeling of no matter whether a venture capitalist would be an excellent in shape. (More on this after)

3) We prioritized speed in excess of bucks

Our emphasis to do this elevate was on rate. In accordance with Preqin, in 2016, it had very first time account executives an average of 17 many months to seal a first fund. For all of us, we made a decision that individuals truly planned to boost our fund in less than annually (and inevitably closed up in 10 a few months). So, we desired to decide for less money within a more quickly speed if this recommended elevating only $5-10m compared to $10m-$20m in twice the time. Simply because they will make decisions easily.

The main reason why quickness mattered to us is the fact that each SEC principles, we could not market our fund while we were fundraising. As internet marketers, we needed to start attempt to advertising and marketing Hustle Fund as quickly as possible.

4) We iterated our deck a whole lot!

Storytelling is incredibly essential for any fundraise. As a new VC, we possessed no brand and no solution to display. In many instances, there’s basically *absolutely nothing* that separates a brand new VC from all the other account managers.

The earliest version of the deck simply mentioned the way you experienced some edge because we went along to “fancy” institutions, performed at “fancy” employment and were definitely effective seed brokers. And I Also consider my pal Tim Chae essentially investigating that slip and proclaiming that each and every account supervisor for the fundraising circuit possessed anything we possessed. In which he was ideal. The countless new VCs that are out pitching right now all traveled to some permutation of elegant institutions and/or been working at expensive corporations and/or have done some pretty trading. These are typically not differentiators!

Originally submitted by several-comic-awesomeness

We swiftly saw that we essential for you to show a differentiated storyline. For people like us, our biggest differentiator is approximately our style of how you commit – namely, we start looking intensely at speed of setup in committing the majority of our account. This was not only a scenario about staying different but in addition around why our recent expertise has directed us to this model and why we have been distinctly skilled to get this way.

It had taken us about 20 variations in our slide deck to hit this tale correct. On account of many people who presented us feedback on our storyline and particularly to Tommy Leep, who assisted us get our history on the right track in the beginning. If you achieve the opportunity work with him on your own pitch – whether you are a account or simply a start-up – do it.

What Make Startup VC Don’t need You To Know

5) We constructed energy by loading in a great deal of events. I personally managed 345 fundraiser gatherings between July 9, 2017 – May 25, 2018

Before, I’ve created concerning how to generate the fear of losing out (FOMO) among the buyers when you’re boosting for your own new venture. Initially when you have elevated not a thing, it is difficult to create FOMO. Whether elevating cash to get a new venture or maybe a VC, no trader desires to be initially sign in. So the best way to clearly show fundraising momentum when no hard earned cash has become fully commited would be to pack in a number of fundraising events events. This will make it much easier to bring in enthusiasm when prospective traders perceive that other brokers are performing secondly get togethers together with you. And you also want all shareholders to end up investing in you about the same time.

Venture Capital Funding Blueprint – Rinse And Repeat

As soon as you get commits, then you may begin talking to other possible investors about the commits, which makes even more commits. The trick is that you must always be meeting with others.

Here’s a graph among all my get togethers every 7 days among Summer 2017 and Spring of 2018:

Note: this doesn’t consist of most of the get togethers that my co-creator Eric Bahn managed. We quite often have initial conferences with prospective buyers on their own. So collectively, our entire amount of events was a lot higher than 345!

You will notice this Google spreadsheet of my events to get a feeling of a few things i have weeks time to week.

You could also see with this graph that I started to use up all your brings! This is a vital factor – never run out of business leads! (a little more about that down below)

6) We begun that has a very low the bare minimum check sizing to close investors swiftly and lifted it as time passes.

In the beginning, our minimal look at measurements began at $25k and in the end it gone all the way close to $300k (for person purchasers). We do this to build quick build and commits much more FOMO.

Product startups can perform this very. I did so this with my business LaunchBit — our most basic check out size back then was $5k, after which we elevated the the very least.

7) We qualified traders on primary achieving

List of top Malaysia Venture Capital Investors | Crunchbase

www.crunchbase.com › hub › malaysia-venture-capital-investors

This list of venture capital investors headquartered in Malaysia provides data on their investment activities, fund raising history, portfolio companies, and recent …

Never Endure From Venture Capital Funding Once more

Once I stated previously, we were hoping to find traders we could special swiftly. For individuals at more compact examine styles, this typically intended just 1-2 group meetings. When someone was acquiring a long time to decide on in accordance with the quantity of determination producers involved and the potential take a look at measurements, then that investor was perhaps not a fantastic suit for our account, much like with start up fundraising events. You would like to be increasing from those who are really got into what you are doing – not folks who shall be an uphill battle to encourage.

There had been some folks, who we satisfied, who just have been not quite all set to shell out either because they were fresh to/not at ease with the VC resource category or these people were not yet obtained into us / Hustle Fund being a initial fund. Which was perfectly good – the important thing was just to shape that out easily and go forward and crank out a lot more meet up with and brings more new people today.

Because I do believe on the list of top mistakes I made in fundraising events to be a product or service start up creator and among the very best fundraiser errors most first-time fundraisers make is within expending too much effort with others who just will not special swiftly adequate,

This is actually essential. It’s attractive to hang out with any opportunist who will require a getting together with on you. And also it usually seems like it’s hard to create new qualified prospects. These days that I’ve performed this a few times, the more suitable solution is to try to maintain trying to find new hotter business leads rather than to actually feel jammed starting to warm up cold models.

8) We produced numerous business leads (initially) making use of brute drive

Building in my issue previously mentioned, I think one of many leading reasons founders (or account leaders) spend a long time on meetings with people who find themselves plainly not gonna invest quickly is simply because do not know how to locate even more prospects. If you’re a program new venture and you have exhausted a normal selection of VCs (like this an individual from Samir Kaji to begin with Republic), you are probably curious about, “Now what? ” Where do I go now to improve cash?

After I became a founder, this became surely the attitude I needed. My point of view now, although, is the environment is full of endless income places, and it’s my work to search for the proper games at the earliest opportunity. This mentality also usually takes the strain out of greatly. For a founder, I felt many stress to seal an individual guy, since it just sounded like there was a finite pool of start-up shareholders. With a more seasoned view, I really feel no stress at all, since there are actually a number of people who will be intrigued around in the world – you need to simply find them.

Meaning that you must be producing loads of engaging in and business leads loads and plenty of very first conferences (see graph previously mentioned). So, how did we create prospects?

We employed a fairly typical B2B product sales playbook to accomplish this:

8a) Get recommendations

If they were considering investment or recognized 1-2 people who could be curious about communicating with us about probably investment Hustle Fund,

We commenced by getting close to pals and associates and required everyone. Because individuals know a lot of people, this truly helped us to department out really easily! And people people today know plenty of people! So, even when you are beginning from somebody who does not have any money or is not really thinking about committing to VC, by merely seeking just 1-2 stable intros, you can easily get some exciting relationships.

I wish to emphasize the want “1 to 2 intros”. The check with is NOT, “Hey knowing everyone which you think is actually a decent fit” <- NO! People will just brush you off and not think about your ask. You want each person you meet to legitimately think about the best-fit person in his/her network out of the thousands of people they may know. Having a specific simple ask to just think about one person in 2 minutes is a doable / realistic ask of everyone you know no matter how close you may be to him/her.

In an effort to have a good community, you ought to be anyone like Ashton Kutcher and have an amazing system,. That’s

5 Ways Twitter Destroyed My Venture Capital Funding With out Me Noticing

The other thing i consider men and women easily expect. That unquestionably will help! But it’s not required.

These include the many people I built this reference consult of:

– Family

– Friends

– Friends’ households

– Former co-workforce

– Former creators I’ve backed often during the past or provide

– People I fulfilled at occasions in which I spoke

– Organizers of activities the place I spoke

– Where proper, I even questioned some founders who pitched me at Hustle Fund on his or her businesses!

If you feel over it from this viewpoint, for anybody who is on the technological industry, there are plenty of men and women you are able to pitch / get referrals from. Every technological staff member is realistic sport – did you know just how much technician staff make each year? So, a great deal. funds. Are you aware of what percentage of them know other tech personnel? Those are the only persons they chill with. Any start up founder you are aware of – regardless how significantly they can be doing well or flailing — is aware of investors that have supported them or another start-up creators.

The right way to Change into Higher With Venture Capital In 10 Minutes

On our $11.5m fund, a lot of it, such as all of our biggest anchors — specific thanks a lot toShanda and LINE, and Naver — originated in testimonials – not from inside our immediate community of folks we already understood. A lot of our brokers are referrals who obtained other testimonials.

So how can you smooth pitch an individual? (and you should be delicate pitching literally all people you fulfill)

You understand when people request you, “Oh how do you find yourself, what exactly are you nearly today? ” That’s your window to very soft pitch. “Great! I started this new fund. Right now, I’ve been, ya know, elevating some cash correctly. So, i want to conversation should you or a pair buddies you realize have an interest in using a look! ” Gauge the impulse. Try out to build an even more conventional meeting to successfully pitch if it’s favorable. Want 1-2 referrals.

Working with a Cialdini-esque method, you should require the moon. Individuals will sometimes accomplish it, and that is great. Or if perhaps they can’t, they feel poor and would like to be useful and can probable help you with whatsoever lesser inquire you have. Referrals are that small question and also were actually clutch system to help us improve our fund.

Startup VC Like A professional With The assistance Of those 5 Tips

I very soft pitched everybody at every get together I went along to. I smooth pitched my optometrist throughout my eye scheduled visit. Under Obamacare, you now get in essence a cost-free reaching to pitch a health professional while getting a examination. A medical expert / dental practitioner / optometrist / lawyer / accountant – these are everybody it is possible to pitch or ask for testimonials from when you meet up with them (and they all have hard earned cash 🙂 ).

We inquired some of our better friends for lots of referrals (a lot more in comparison to the 1-2 that we stated previously). People were *so incredibly useful*. I almost certainly owe them my 1st delivered baby, but I’m not sure they would actually get pleasure from the tantrums.

It’s a way to start to get tapped into systems you do not have.This word of mouth technique is a lot of function and requires a lot of meetings>

8b) Throw functions / brunches / meals / gatherings

Some of our good friends had been somewhat awkward carrying out introductions for the purpose of fundraising events. Cash is an interesting issue that men and women never like to discuss very much in america. Many people check out expense options as prospects and also other folks perspective them as obligations (as stated before).

So, an alternative method we used from time to time to receive testimonials would be to request our associates to toss celebrations / dinners / brunches and invitation people we wanted to meet. So, in the event your good friend is attached to anyone you would like to fulfill, another solution question is to request your buddy to throw a evening meal / brunch (and you pay for it) and bring both equally you and also that person you would like to meet. Then you may soft pitch straight a person you intend to connect with with no your buddy having to feel cumbersome.

Interestingly adequate, I found that business owners and purchasers ended up pretty cozy doing straight introductions for many people, while my girlfriends which have generally worked well at significant commercial work opportunities (and also have in no way brought up income ahead of), have been a smaller amount secure. And that is alright. The celebration / meal / brunch route is really an choice path to a similar end result. We ended up being participating in many lunches / dishes / functions that are not mirrored during the getting together with-depend on the graph earlier mentioned.

On top of that, we also threw a great deal of dinners / speaks / celebrations / events our selves, and we also welcomed both equally folks we were conversing with and determined buyers to those activities. These functions were definitely helpful in shutting brokers likewise.

Talks at conventions were actually also a good way to display information and gives folks feelings of how we contemplated ventures. Now we have ended up being assembly quite a few possible LPs from conventions and situations the place we gave discussions. Events permit you to be “thought leader”.

8c) Do your individual routine corresponding

Once we started acquiring purchasers, we noticed some habits emerge. Despite the fact that we obtained specific our elevate generally in the Bay Area and did not vacation much, a lot of our traders are from away from the Bay Area. We conjectured that there may be much stronger attention away from the Bay Area, where by admission to technician startups, has limitations.

Simply because it would turn out, nearly half of the profit our account originates from Asia (not Asian Americans but from Asia-Asia) despite the fact that we did not make any travels on the market.

But styles can even be thesis-motivated. Another pattern we identified for Hustle Fund was that anybody who had been a teacher for or even a supervisor associated with an accelerator seriously resonated with your thesis and dedicated to our fund.

It will be worth sharpening in on the design and looking for as many folks who match that layout.

Speaking of habits, one particular appealing aspect note observation is usually that we possessed genuinely terrible being successful in switching feminine brokers (inspite of essentially shelling out in a lot of girl founders either in the past and having Hustle Fund). In Hustle Fund 1, < 5% of our investor base is made up of women. (Defined as: we spoke with a woman from that entity or household). But we have pitched both women and men. I’ve had many other friends who have raised money for funds or startups who have noted similar observations - women are seemingly much more conservative with their investments.

The secret Code To Startup VC. Yours, For free… Actually

Just like a aspect tangent: If people today – guys or females – do not want to get Hustle Account by itself, it’s high-quality. If professional girls with standard of means usually are not getting some economic danger, they will not achieve the same volume of monetary accomplishment his or her guy cousins, but. Consider this – we have a discussion everyday about how females never make your exact level for their male competitors whatsoever these tech corporations. But we never communicate by any means on how most women are left powering on investment strategies. Every rich individual is aware that you do not generate income on salaries – you will be making the majority of your cash on purchases. Should you be inside the seed circular of Dropbox or Google with only a few thousands of bucks spent, you would not be concerned about a compensation.

8d) We crafted a video clip

We produced a movie (see hustlefund.vc) to clarify who we have been. This is a bit of a risk, simply because we invested $13k(! ) all in on producing this video recording. That being said, we think it is worthwhile, due to the fact we considered we might be prominent once we does the recording effectively.

This risk has repaid in spades. In part, I think it is mainly because no other VC (i always are conscious of) possesses a movie on their website. So it can be worthwhile to cover an resource that nobody has so as to jump out.

9) Your most wealthy associates may not be actually your most significant vice and investigations-versa

It turns out there seemed to be no link among prosperity and check measurement.Building at a earlier position about gentle pitching absolutely everyone and everyone>

This became an interesting understanding for individuals. Initially, we produced a long list of our most wealthy associates and how a lot we thought every single could spend. We were so extremely off in meeting these figures. On the other side, some of our pals who are not extremely rich surprised us and devoted dramatically.

Old style Venture Capital Funding

There are so many reasons for this. a) Making a ton of money by itself does not means that men and women have lots of money. They could have a massive home loan. They can expend a lot of money. They could have a number of money linked up in other ventures or investment strategies. b) Additionally, there are a number of people who do not make a lot of cash however they are really good at protecting it and investing it and privately have lots of success. The Millionaire Next Door is a superb example of both these factors. c) Lots of people derive from rich households and you just have no idea which they do. d) People also have various quantities of bullish-ness on you, your thesis, as well as your investment course. People likewise have different levels of possibility / incentive patience.

It’s also important to note that from time to time those people who are not / do not seem like angel purchasers can get angel purchasers for you personally. Andy Cook talks about how he introduced new brokers who experienced do not ever committed to startups just before into his round. We managed just like perfectly. Because somebody isn’t previously an angel entrepreneur doesn’t means that he/she couldn’t be.

For this reason our grassroots strategy of consuming countless meetings worked well so well – we just never ever knew who will in fact be curious about committing. And we could not get anyway to be considered people apriori. This is exactly why it is so important to pitch everyone and everybody – it’s hard to know that will mouthful and who will not.

10) We utilised a CRM to manage our method

As you have to be sure which leads will not be becoming fallen via the crevices,

This approach requires a CRM. We committed to with a CRM without delay to monitor chats to maneuver men and women by way of our pipeline.

Learn how To start Startup VC

And this also created it simpler for Eric and me to separate and overcome – we might have our very own group meetings with individuals and regroup for subsequent get togethers and above. And we could equally see who had been chatting with that making sure that we did not begin distinct chats with assorted folks from the exact same account or method precisely the same people today.

Most of all, it was subsequently vital we preserved discipline total all those several weeks to have the CRM up-to-date.

11) You’re not warm up until the stop

This applies to both equally startups and resources. Fundraising is definitely a slog at the start, simply because you are wanting to bring in numerous leads and are eligible them.

This can be a graph of what our fundraising checked like:

The blue colored lines presents our delicate commits within the a few months (spoken / authored email message commits). The red collection signifies cash we basically closed down officially (finalized docs). As usual, “soft commits” are a bit more committed than exact commits, but finally, they ought to converge (or compare).

The best way to Be In The top 10 With Venture Capital

As you can tell, we averaged finding about $1m a month in delicate commits for your initially 6-7 months to receive around all around $6.5m in commits, which we closed in Dec 2017. If you follow the reddish line, you will observe that we have a increase of $5m right at the end, which essentially came jointly throughout the last couple of months of our own fundraiser process!

Like virtually every raise I’ve noticed, you’re simply not popular up until the ending.

12) This all seems simple but it surely will take hustle In addition to a community to accomplish this!

The fundraising events approach I’ve outlined previously is executable and accessible for anybody. And it also basically noises quick. Just do a lot of conferences and ask everyone for intros or hard earned cash, correct?

But wrapping up this article, I’ll give you a couple of finished views.

12a) It will take numerous hustle and a lot of gatherings to get this performed.

Last July (2017), when my newborn was approximately 7 several weeks outdated, I made the choice to quit my preceding job during my maternity begun by leaving Hustle Fund soon afterwards. That summer months, throughout the day I might abandon him with my mother and father, plus i would move from getting together with to reaching, ending to water pump dairy in SF car parking tons or at large computer companies’ mothers’ places. At night, I would personally work on decks and revise our CRM. I would sleeping about 4 many hours an evening sporadically as being the little one would wake each 2-3 hours to beverage milk. I purchased by means of most days or weeks on a great deal of coffee and adrenaline. But regardless of how exhausted I found myself, it was actually essential to go into each meeting just as ecstatic as it ever was.

I don’t point out this plan to “brag about my hustle,” but simply to paint real life – it really usually takes lots of work to do quite a lot and many conferences. For quite a few points, as smartly as you may job, there is not any quick way for only a lot and many time and energy, while it’s vital that you work intelligent. And be aware that as really hard since it is, you are not the only one.

12b) It takes a community to totally go wherever.

To start this account, I leaned on loads of men and women.

While this small segment here doesn’t do proper rights to my appreciation, I have done need to emphasize how many folks my impressive co-creator Eric Bahn and I roped into this increase. (I’m also remarkably thankful to get a superb co-founder in Eric and now Shiyan Koh! )

Venture Capital Funding Question: Does Size Matter?

– Our ~90 traders in your account (they occupy way much less LP slots but there are a minimum of 90 people / partners / family / folks and corporations using a stake in this particular)

– Past creators I’ve reinforced who may have presented me with their shareholders an individual prosperous creator even generously made available us her PR organization and provided to ft . the invoice!

– Current creators who went through their rolodex in wanting to assist us communicate with their other shareholders / VCs / loaded pals

– VC associates who reinforced us with personal investment opportunities / ventures using their cash / intros with their purchasers

– friends and relations who got to my home to cook meal / carry more than take out / obtain us foods – it was actually very amazing not to need to worry about meal for quite a while

– close friends and family who encased me within their additional bedroom or their couch on my small fundraising events trips given that now we have limited funds

– friends and relations who presented me to many loaded and very well-interconnected men and women

– My blog followers who announced me with their system

– My personal prompt family members who required proper care of my child(s) a week for months!

– And large props to my significant other JJJS and also Eric’s partner and Shiyan’s loved one for genuinely displaying the brunt of all of the perform that enters into beginning a fund.

Remarkable Website – Venture Capital Funding Will Help You Get There

There was many individuals who made it easier for us get this factor functioning (so we are just at the start). And I’m so quite thankful to them all regarding their generosity.