Expect, however, that the company encourages the employee to get in the Exchange, collect the federal aids, and guarantee the whole family– see examples above. In addition, the employer can contribute as an option, state, $100, more or less, each month towards the employee’s health protection. This is called specified contribution. The reception here has been passionate. And why not? Everybody benefits.

Insurance coverage is a discomfort in the proverbial and insurer are after every dollar they can get, for the a lot of part. A needed evil. If you find a great company stick with them, and do the mathematics on the premiums to work out if you truly require the geico home insurance reviews. Sometimes the excess charged makes the insurance coverage void. Doing a great deal of mindful analysis on insurance coverage will save you a fortune.

Just tape-record the deduction on Kind 1040, line 29. I must advise you that I am a Health Market and Health Insurance expert and NOT a Tax expert. Subsequently, I need to refer any insurance tax related questions or issues you have to your tax consultant. However as far as health insurance coverage for the self used is worried, I understand that this can be done and these are the guidelines as much as and consisting of 2009.

When you own and home owners insurance and auto insurance administer your own health strategy you get to set the limitations. Through the strategy agreement you decide the level of healthcare advantages for yourself and for your workers. Due to the fact that there is no intermediary there are no premiums to pay. In a Corporation you can set tears or levels of advantages. Upper management has a much greater pay level and much more duty, which enables you to also provide greater benefit levels. Proprietorship can develop a plan and have it administered through a company like Gumboot Service Providers. They likewise get to set their limits.

The alternative minimum tax remained in the beginning designated to make sure high-earning Americans paid their reasonable portion of earnings taxes. But it hasn’t been substantially changed over the years and captures more and more middle-class people.

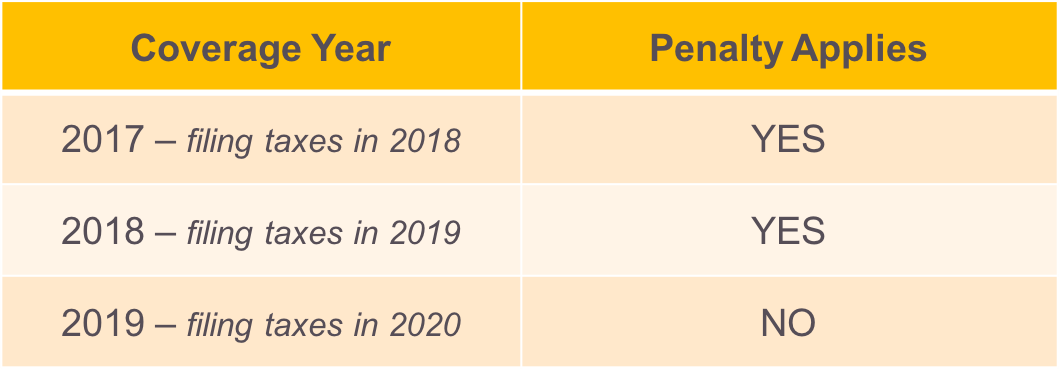

Lastly, it needs to be pointed out that there are tax-penalty effects for not having actually qualified necessary health insurance coverage, beginning in 2014. While a complete treatment of how the charges work is beyond the scope of this article, a minimum of I offer this to give agents and brokers some concept regarding the quantities of taxes included to your customers’ income tax filings. In 2014, there will be a 1% of tax filing above the threshold. For a household of 4, the design in this post, at $50,000, that would be some $500. In 2015, the amount goes to 2%, or $1,000. In 2016 and beyond, the figure is 2.5%, or $1,250. Encourage your clients to see their accounting professional or tax consultant for exact understandings and computations for each case where insurance coverage is not purchased.

Area 80D of the Earnings Tax Act held Rs. 15,000 as the maximum quantity that can be claimed on medical insurance coverage. The bill passed in the 2008 budget declared that apart from Rs. 15,000 for the medical insurance of you and your household, you could claim an additional Rs. 15,000 for the medical insurance of your parents. As per the modified provision of Section 80D, you can now declare an overall amount of Rs. 30,000.

Terms and definitions. There are 5 levels of certified necessary health advantage selections: Platinum, the most expensive in gross premiums, is anticipated to pay for about 90% of claims; Gold, which is anticipated to pick up 80%; then there is Silver at 70%, and Bronze at 60%. For those individuals thirty years and under, there is the disastrous high deductible strategy. These are complete and extensive major medical prepare for individuals and families. All strategies are ensured concern. There are no pre-existing conditions.