Audit notices are sent by excellent mail not emailed or done from the telephone, between the period of 12 and 18 months after your tax return is sent in. If there is no notification within 18 months, you not just about guaranteed to be audited.

All in all, a correspondence audit is as opposed to a big manage. If you receive that notice the particular mail, relax and calmly address has already been considerably. As mentioned before, you might end up owing a little more on your last or you might find that the irs has made a mistake and also you own nothing. Trust me, things become worse.

The is around central economic auditing management app through monetary administration. They usually do it secretly where the chairman is the boss. Are usually down to the level where on individual can dictate how much we are suppose to have circulating and what the interest rates should automatically be. That is the worst form of central economic planning that individuals can ever have.

Have every in your office gotten a copy and actually read the guidelines, handbook, or schemes? If they do n’t have a copy, where become the printed copies and have these been properly financial audit distributed? Perhaps a fresh batch of hand outs this would definately be very essential.

At least once per year, and preferably monthly or quarterly, do a spreadsheet that accumulates the shared services costs and apportions them among the business units in line with the cost driver operators.

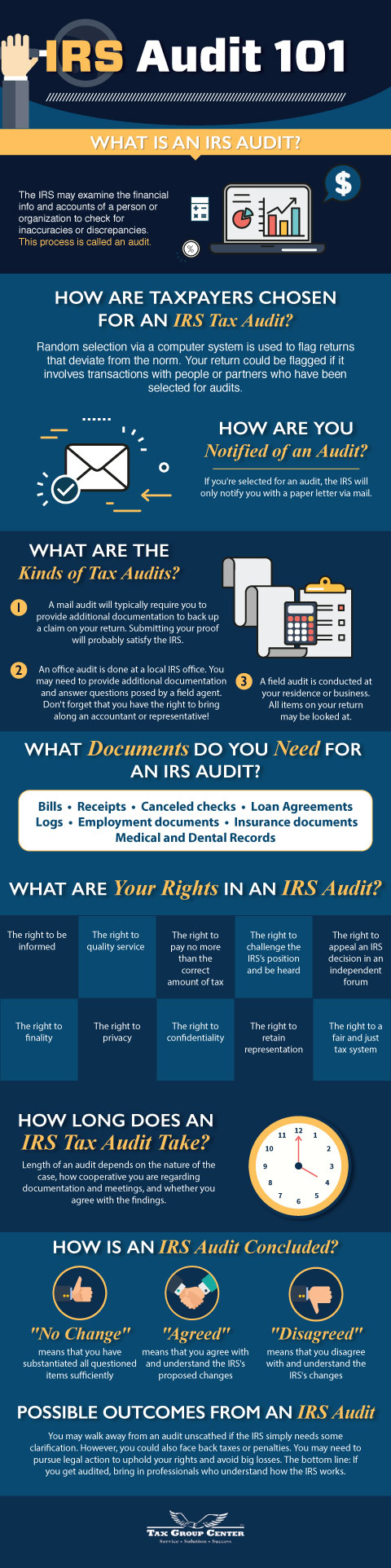

An IRS Tax Audit is a procedure where an IRS Agent questions the correctness of one’s Income Tax-Return. Being selected for an over at this website doesn’t necessarily mean that your Income Tax-Return is incorrect. The IRS is merely calling upon you to verify it. Often, IRS Audits will scrutinize the validity of tax deductions, but in recent years the IRS has begun looking in the validity of one’s income on the tax send.

You end up being very thorough with your responses and a person address her. Make sure that you provide detailed explanations every single question and proof of your explanations noticable your issue. Supporting documents are very important in the deal of closing an audit. The IRS wants to ensure that you are telling the truth with regard to your responses.

The employee clearly expects you end up being impressed with this letter, nevertheless, you instead feel disoriented. like everyone else is in on the joke except you.