As elements of at the outset, underreporting income is pretty common in america. One in every seven taxpayers owes back taxes, relating to a recent estimate. But because of ambiguous laws and government bureaucracy, collecting these debts takes time period. Even if the IRS is patient in collections, there are situations when all the waiting in the world will not help the tax debtor earn the necessary to repay their tax owed.

Another aspect that must be be given a thorough look is that if there is anything to worry about with regards to the current audit tax delivers. If these issues are solved and answered satisfactorily, one may stop fretting over an watch this video.

The assessment should continue to the inside your house as highly. Try to in your home with new eyes so that you don’t overlook things simply since see them every business day.

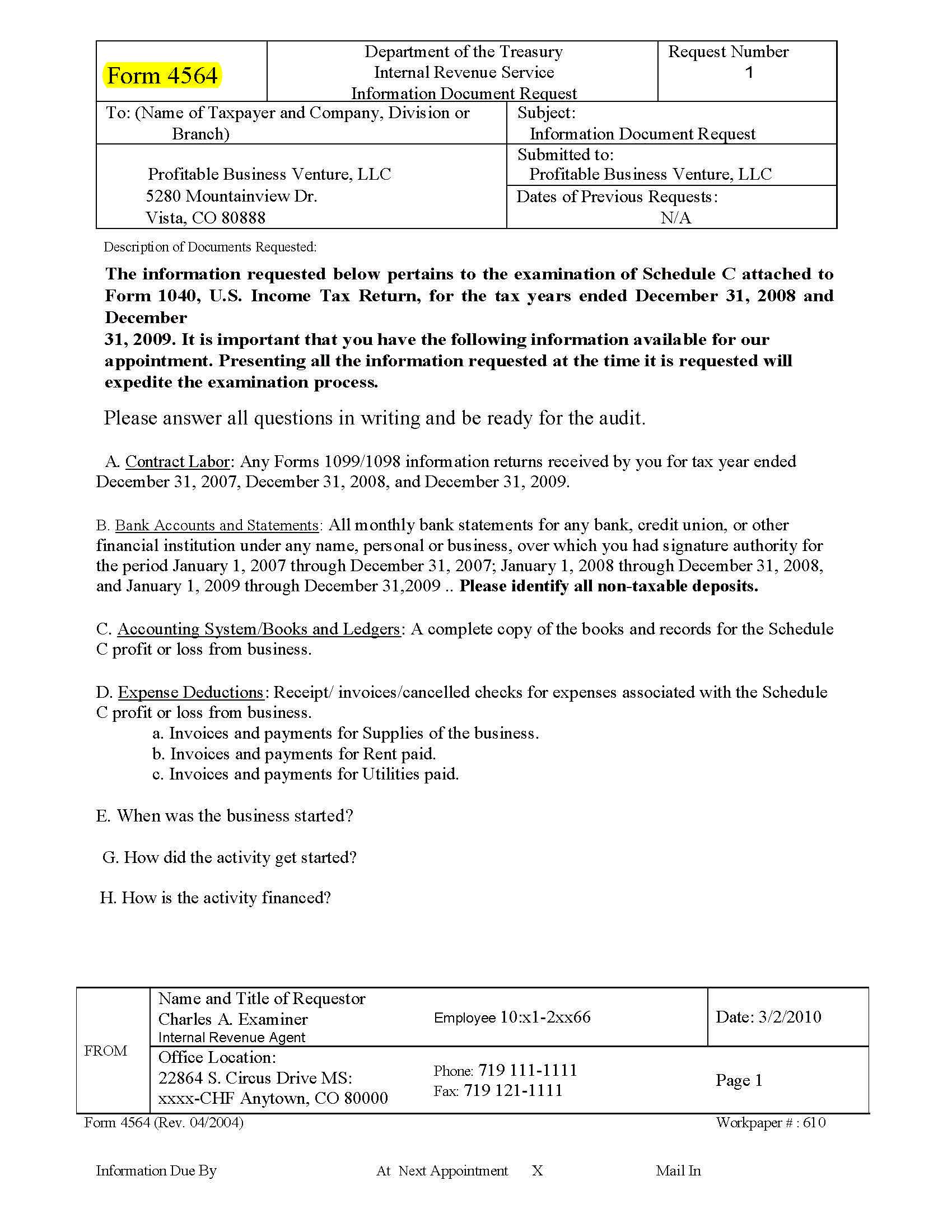

Respond with the due big date. This is one of the primary things that are needed to could. If you do not respond in time your case will go to collections. Should a case gets to collections you will have very little room to barter. If you believe you may not be able to respond you must then you must request a postponement up until the specified date on your letter.

The statute of limitations or time audit period starts only if and while you file returning. If you have not filed taxes and is not received audits from the irs you have most likely escaped their audit course of.

The IRS assumes that many people can’t support their tax return in the style that the government requires. I am frequently get “no change” audit results. Auditors usually like to look good to their manager. Managers require that financial audit work papers contain copies of support data. When the auditor doesn’t have documentation to support their work papers, they’ll deny a deduction. You are beg people want, but if they don’t think their manager will be happy, they’ll deny your deduction. Plan to give them some adjustments in their favor, or auditing management app you are setting yourself up for disappointment.

You could do really DIY Home Energy Taxation. For about $200 you should buy a home power monitor and connect it to your circuit crusher. The monitor records and calculates the associated with electricity. Another alternative is often a kilowatt meter, about $30, which measures the energy use virtually any device attached to it.

“Any one may so arrange his affairs that his taxes shall be as low as possible; he isn’t bound to select from that pattern which will best spend the money for Treasury; there’s not even a patriotic duty to increase one’s tax.” Helvering v. Gregory, 69 F.2d 809, 810 (2d Cir. 1934).